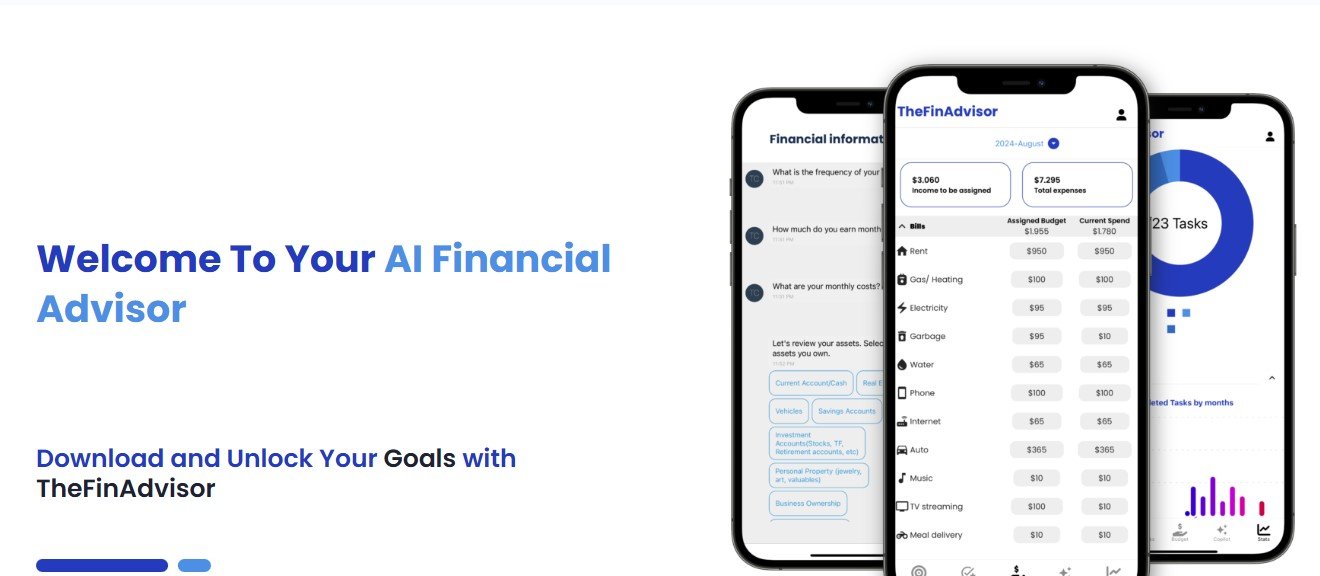

TheFinAdvisor is a powerful AI-driven financial platform designed to simplify personal finance management. From paying off debt and investing in markets to planning for retirement or purchasing a home, TheFinAdvisor offers personalized strategies tailored to your unique goals. Combining expert insights with intelligent algorithms, it ensures that users receive actionable guidance to navigate their financial journeys effectively.

Features

- AI-Powered Personal Financial Advisor

- Tailored recommendations for budgeting, investments, and long-term financial planning.

- Debt Management Tools

- Strategies for paying off credit cards, student loans, and restructuring debts.

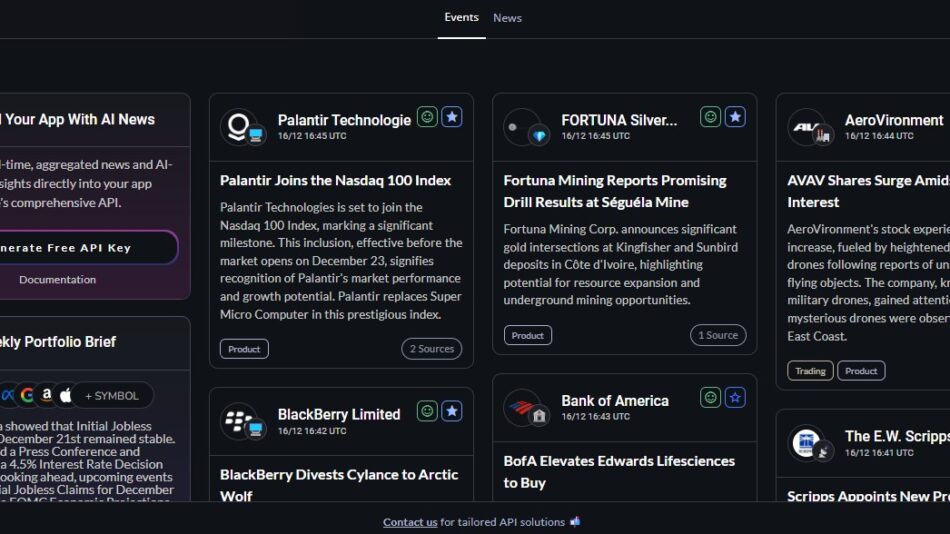

- Investment Planning

- Personalized investment advice for stocks, bonds, crypto, and real estate markets.

- Goal Tracking

- Helps users set, track, and achieve financial goals such as early retirement, buying a home, or starting a business.

- Educational Resources

- Expert insights on financial topics, from daily trading to budgeting, accessible through an intuitive interface.

- Global Accessibility

- Available on both iOS and Android, ensuring seamless access for users worldwide.

How It Works

TheFinAdvisor uses AI to analyze your financial data and provide actionable recommendations. Users input their goals, such as paying off debt or saving for retirement, and the platform generates step-by-step strategies to achieve them. The app also tracks progress, adjusts recommendations dynamically, and offers expert-backed insights for informed decision-making.

Use Cases

- Young Professionals

- Plan for debt repayment and start building a solid financial foundation.

- Families

- Budget effectively while saving for major expenses like homeownership or travel.

- Investors

- Explore personalized strategies for investing in diverse markets, including stocks and cryptocurrencies.

- Retirees

- Maximize savings and optimize income during retirement.

Pricing

- Free Plan

- Basic tools for budgeting, financial education, and limited AI insights.

- Premium Plan

- Pricing available upon request, includes advanced investment strategies and personalized financial planning.

Strengths

- Customizable Financial Guidance: Tailors advice based on personal goals and financial situations.

- Comprehensive Solutions: Covers a wide array of financial topics, from debt to investments.

- Ease of Access: Available across mobile platforms, ensuring financial management on the go.

Drawbacks

- Subscription Required: Full access to advanced features may require a premium plan.

- Integration Dependency: Optimal performance depends on linking external financial accounts.

Comparison with Other Tools

TheFinAdvisor stands out with its AI-driven, personalized approach to financial planning, unlike Mint, which focuses mainly on budgeting, or Robinhood, which specializes in investments. Its combination of comprehensive financial management and tailored advice ensures a more holistic user experience.

Customer Reviews and Testimonials

- Alex P.: “TheFinAdvisor transformed my financial habits. I’m finally on track to retire early!”

- Sarah W.: “The personalized investment strategies are incredible. I feel confident managing my portfolio.”

- Raj T.: “It’s like having a financial coach in your pocket. Highly recommend!”

Conclusion

TheFinAdvisor is an all-in-one platform for individuals aiming to achieve financial freedom and security. By offering personalized advice, investment strategies, and goal-tracking tools, it simplifies financial management for users at every stage of their journey.

Visit TheFinAdvisor to explore its features and start achieving your financial dreams today.