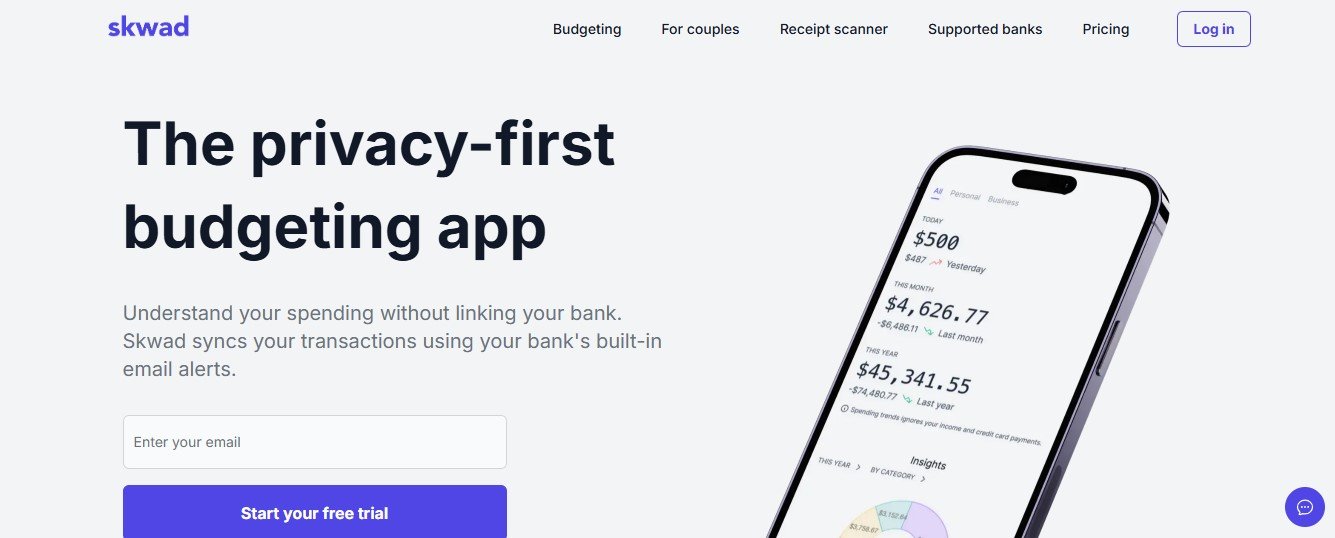

Skwad is a privacy-first budgeting app that helps individuals track expenses and manage budgets without linking their bank accounts. By syncing transaction data from bank email alerts, Skwad eliminates the need for sensitive login credentials while delivering real-time insights into spending habits. Perfect for users prioritizing security and control, Skwad also supports manual uploads, customizable categories, and shared financial tracking for couples or groups.

Features

- Email-Based Expense Syncing

- Converts bank email alerts into categorized transactions instantly.

- No Bank Logins Required

- Prioritizes privacy by removing the need for account credentials or third-party aggregators.

- Auto-Categorization

- Automatically organizes expenses by type, offering clear insights into spending.

- Customizable Categories

- Users can recategorize, split, or hide transactions for tailored financial tracking.

- Shared Budgets

- Invite partners or companions to collaborate on budgets, with one free additional user included.

- File and Receipt Imports

- Supports uploads from CSV, Excel, Quicken, or receipt images for additional transaction tracking.

- Notifications and Insights

- Sends alerts for upcoming bills, spending trends, and savings opportunities.

- Export Capability

- Export data in CSV format for offline analysis or tax preparation.

How It Works

- Set Up a Scan Email: Receive a unique email address to forward transaction alerts from your bank or credit card.

- Email Forwarding: Configure automated alerts from your financial institution to Skwad’s secure email.

- Categorization: Skwad processes and organizes transactions, presenting them in an intuitive dashboard for analysis.

Use Cases

- Privacy-Focused Budgeters

- Track finances securely without sharing sensitive bank details.

- Couples and Groups

- Collaborate on budgets and manage shared expenses effortlessly.

- Spreadsheet Users

- Transition from manual spreadsheets to an automated, user-friendly interface.

- Independent Professionals

- Manage personal and business expenses in one platform with categorization flexibility.

Pricing

- Free Trial: Explore all features for a limited time.

- Subscription Plans: Starting at $59/year (discounted for annual payments).

Strengths

- Privacy and Security: No passwords or sensitive bank data required.

- Ease of Use: Simple setup using existing bank email alerts.

- Real-Time Insights: Transactions appear instantly after email alerts are received.

Drawbacks

- Limited Mobile Availability: The app is currently in beta for iOS and Android.

- Bank Email Dependency: Requires banks to support email alerts for automated syncing.

Comparison with Other Tools

Unlike traditional budgeting apps like Mint or YNAB, Skwad doesn’t require users to link their bank accounts, providing a secure and privacy-friendly alternative. Its focus on email alert integration sets it apart as a unique solution for users uncomfortable with third-party aggregators.

Customer Reviews and Testimonials

- Sonya O.: “I was never comfortable sharing my bank passwords. Skwad saves me hours every month while keeping my finances secure.”

- Tammy C.: “I uploaded over 6,000 transactions, and Skwad processed them instantly. It’s great for tracking personal and business expenses.”

- Jason C.: “Skwad is the only app that never has issues pulling transactions from my bank.”

Conclusion

Skwad is the ultimate tool for secure and efficient financial tracking. By leveraging email alerts and eliminating the need for sensitive bank logins, Skwad delivers a privacy-focused approach to budgeting. Its customizable features, real-time updates, and shared tracking options make it a standout choice for individuals and couples alike.

Visit Skwad to start your free trial and take control of your finances today.