Investment management can be complex, especially when trying to balance risk, performance, and diversification. PortfolioPilot simplifies this by providing AI-powered insights, personalized investment strategies, and real-time portfolio analysis. This article covers PortfolioPilot’s features, use cases, pricing, and benefits, illustrating its role in enhancing investors’ decision-making.

Description

PortfolioPilot is a portfolio management platform that leverages AI to provide investors with actionable insights, risk assessments, and investment recommendations. Designed for individual investors and financial advisors, PortfolioPilot analyzes users’ portfolios and generates data-driven strategies for improving performance, reducing risk, and enhancing diversification. With a range of analytics and custom reports, PortfolioPilot helps users make informed decisions, whether they are seasoned investors or newcomers to the market.

Features

PortfolioPilot offers several key features for effective portfolio management:

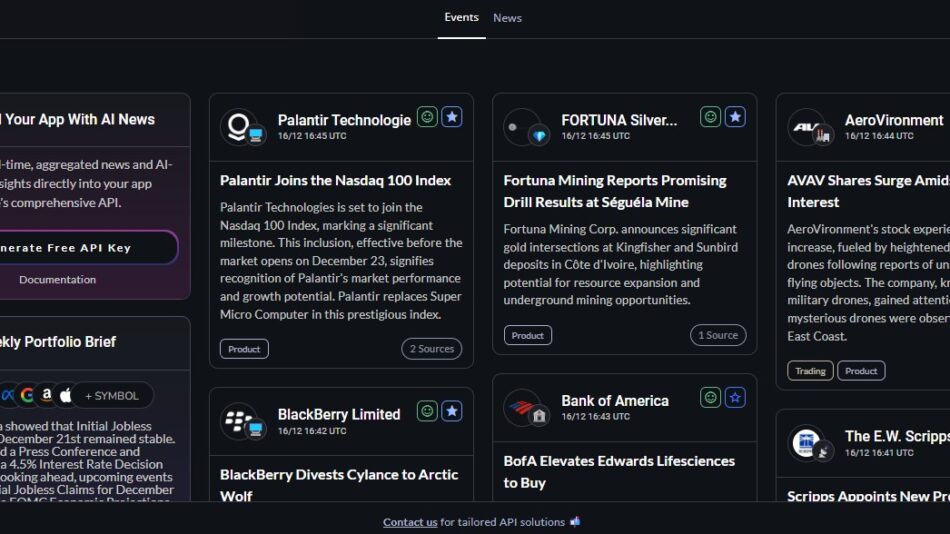

- AI-Powered Analysis: Uses AI to analyze portfolio performance, highlighting opportunities for improvement and assessing risk levels.

- Real-Time Market Data: Provides up-to-the-minute market data to keep users informed of fluctuations that may affect their portfolios.

- Diversification Insights: Offers suggestions to improve diversification, helping investors spread risk across assets and sectors.

- Customizable Reports: Generates personalized reports on portfolio performance, asset allocation, and risk exposure.

- Investment Recommendations: Recommends adjustments or new assets based on individual goals, risk tolerance, and market conditions.

- Goal Tracking and Alerts: Tracks investment goals, sends alerts on portfolio performance, and notifies users of potential risks.

- Tax and Cost Optimization: Identifies ways to reduce tax liabilities and optimize costs, particularly useful for long-term investors.

- Integration with Brokerages: Connects with popular brokerage accounts for seamless portfolio import and analysis.

How It Works

PortfolioPilot offers a straightforward process to provide valuable insights and recommendations:

- Portfolio Import and Setup: Users link their brokerage accounts or manually input holdings, giving the platform a view of their assets.

- AI Analysis and Insights: PortfolioPilot’s AI engine assesses portfolio performance, risk, and diversification, generating tailored insights.

- Personalized Recommendations: Based on the analysis, the platform suggests changes in asset allocation, potential investments, and strategies for tax efficiency.

- Continuous Monitoring: PortfolioPilot tracks market shifts and portfolio performance, sending alerts and periodic reports to keep users informed.

Use Cases

PortfolioPilot is designed for various types of investors, from beginners to experienced advisors:

- Individual Investors: Provides insights and recommendations for those who want to optimize their personal portfolios and make data-backed decisions.

- Financial Advisors: Helps advisors assess client portfolios, offering data-driven insights and tools for better client communication.

- Retirement Planning: Supports individuals in aligning their portfolios with long-term retirement goals by tracking and adjusting based on risk tolerance.

- Tax-Conscious Investors: Assists in minimizing tax impact on investments, particularly for those looking to enhance after-tax returns.

Pricing

PortfolioPilot typically offers a free basic plan, with premium features available in tiered subscription plans. The paid options may include advanced analytics, personalized recommendations, and integration with multiple brokerage accounts. For specific pricing, users are encouraged to check PortfolioPilot’s website or contact the team for custom solutions.

Strengths

- AI-Driven Precision: Provides data-backed insights, helping users optimize their portfolios with minimal manual research.

- Real-Time Alerts: Keeps users updated on market changes, portfolio risks, and recommended actions.

- User-Friendly Interface: Designed for accessibility, allowing users of all experience levels to navigate the platform easily.

- Comprehensive Reports: Generates detailed reports on performance, risk, and diversification, ideal for tracking investment goals.

- Seamless Brokerage Integration: Enables users to connect accounts from various brokers, simplifying portfolio monitoring.

Drawbacks

- Limited to Data-Driven Insights: PortfolioPilot may not provide personalized advice like a financial advisor, limiting its use for complex planning.

- Focus on Self-Managed Portfolios: Investors who prefer hands-on financial planning may need additional advisory services.

- Costs for Premium Features: Advanced features may come at a higher subscription cost, particularly for users with large or diverse portfolios.

Comparison with Other Tools

Compared to platforms like Personal Capital and Wealthfront, PortfolioPilot stands out for its emphasis on AI-driven insights tailored for individual investors managing diverse portfolios. While Personal Capital provides comprehensive financial planning, PortfolioPilot’s focus on asset allocation, risk, and tax optimization makes it particularly beneficial for those interested in detailed portfolio analytics. Wealthfront, which emphasizes robo-advisory services, may appeal more to passive investors, whereas PortfolioPilot suits investors who want in-depth control over their portfolios.

Customer Reviews and Testimonials

Users of PortfolioPilot frequently highlight the platform’s user-friendly design and detailed analytics. Many appreciate the personalized recommendations and alerts, noting improvements in portfolio performance and risk management. Testimonials also mention the value of real-time market data and customization features, which help users align their portfolios with evolving goals and market conditions.

Conclusion

PortfolioPilot is a robust portfolio management tool designed to empower investors with AI-driven insights and personalized recommendations. By offering in-depth analytics, risk assessment, and goal tracking, it provides users with the information they need to make data-backed investment decisions. For individuals or advisors looking to optimize portfolios, enhance diversification, and minimize risks, PortfolioPilot offers a comprehensive, user-friendly solution.

To learn more about features or request a demo, visit PortfolioPilot’s official website.