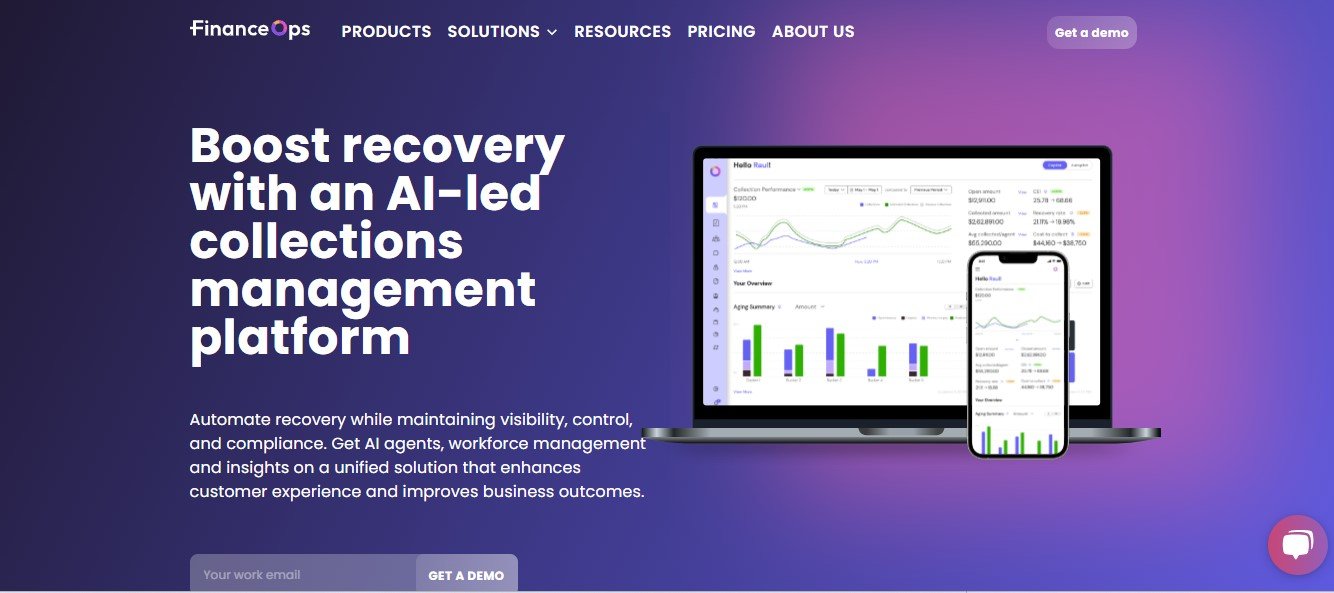

FinanceOps is a fully autonomous finance operations platform designed to modernize and streamline back-office processes for businesses. By leveraging AI-driven automation and predictive analytics, it optimizes tasks such as collections management, accounts receivable, financial reporting, and risk analysis. FinanceOps empowers businesses to reduce operational costs, maintain compliance, and improve cash flow management, all through an intuitive and secure platform.

Features

- AI-Powered Collections Agent

- Automates end-to-end collections with “Alice,” an AI agent handling communications, follow-ups, and payments.

- Accounts Receivable Management

- Automatically creates, verifies, and sends invoices while predicting payment delays for improved cash flow.

- Advanced Risk Management

- Analyzes customer profiles and behaviors to identify at-risk accounts and prevent delinquencies.

- Financial Reporting and Analysis

- Generates detailed reports on revenue, expenses, and profitability for real-time insights.

- Customer Engagement Tools

- Provides self-service options and dispute resolution powered by AI for 24/7 customer support.

- Workflow Optimization

- Categorizes customers, creates personalized workflows, and optimizes processes based on analytics.

How It Works

FinanceOps integrates with existing financial systems, utilizing AI to process and analyze data from customer interactions and accounts. Its intelligent agent, Alice, automates tasks like dunning efforts, invoicing, and collections. Meanwhile, real-time insights and predictive analytics help businesses make data-driven decisions.

Use Cases

- SMBs

- Automate collections and reduce manual workload to improve cash flow efficiency.

- Fintech

- Streamline financial operations while maintaining compliance and minimizing delinquencies.

- Healthcare

- Ensure timely payments with AI-driven risk assessment and accounts receivable automation.

- Law Firms and Credit Unions

- Manage detailed financial records and optimize invoice collections while reducing administrative overhead.

Pricing

FinanceOps provides custom pricing based on business needs. Users can request a demo to explore tailored solutions.

Strengths

- Complete Automation:Reduces manual tasks and operational costs significantly.

- Scalability:Supports businesses of all sizes with flexible and robust features.

- Real-Time Insights:Provides actionable data quickly, improving decision-making.

Drawbacks

- Pricing Transparency:Lack of upfront pricing may deter potential users.

- Integration Dependency:Requires integration with existing financial tools for optimal use.

Comparison with Other Tools

Unlike traditional finance software, FinanceOps offers a fully autonomous solution driven by AI, covering both operational and strategic needs. Its unique capabilities, such as an AI collections agent and risk profiling, set it apart from competitors focused solely on accounting or analytics.

Customer Reviews and Testimonials

FinanceOps is praised for its ability to automate time-consuming processes and improve cash recovery rates. Users highlight its AI-driven insights and seamless automation as game-changing for finance teams, allowing them to focus on strategic growth.

Conclusion

FinanceOps redefines financial operations with AI-powered automation and actionable insights. By optimizing collections, reporting, and customer engagement, it empowers businesses to enhance efficiency and profitability. With robust features and scalability, FinanceOps is a vital tool for modern financial management.

Visit FinanceOps for a demo and discover the future of finance automation.