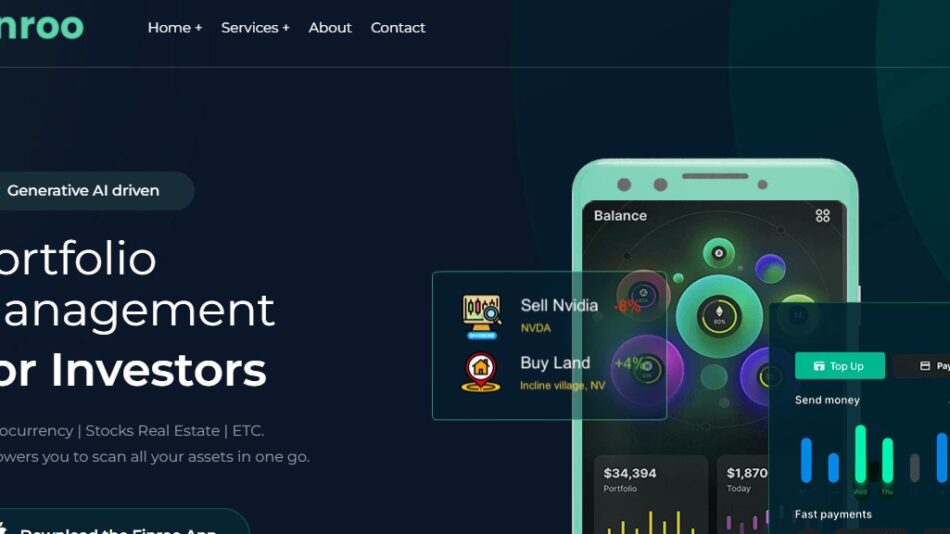

Finalle AI is a cutting-edge platform designed to transform how institutional investors and asset

managers make financial decisions. Leveraging AI-powered analytics, Finalle offers tools for risk

assessment, portfolio optimization, and market trend analysis. It combines data-driven insights with

intuitive visualizations, enabling users to streamline operations, reduce risk, and maximize returns.

Features

1. AI-Driven Portfolio Analysis

o Automates portfolio risk assessment and suggests diversification strategies based on

market conditions.

2. Real-Time Market Insights

o Monitors global markets to provide actionable trends and forecasts.

3. Custom Financial Modeling

o Builds predictive financial models tailored to user needs, optimizing investment

strategies.

4. Risk Management Tools

o Identifies and quantifies risk exposure across assets and portfolios.

5. Data Visualization Dashboards

o Provides clear, actionable visualizations to simplify decision-making for complex

financial datasets.

6. Automated Reports

o Generates customizable reports to share insights with teams or clients.

7. Integration with Financial Systems

o Seamlessly connects to existing CRM and portfolio management platforms for

streamlined workflows.

How It Works

Finalle AI integrates with market data sources and financial systems to gather insights. Users input

their portfolio or financial objectives, and the platform’s AI analyzes trends, risks, and opportunities.

The system delivers real-time visualizations and recommendations to guide investment decisions.

Use Cases

1. Institutional Investors

o Manage complex portfolios with AI-driven insights and risk assessment tools.

2. Asset Managers

o Optimize asset allocations and improve client outcomes using predictive models.

3. Investment Advisors

o Generate client-ready reports with actionable insights and market forecasts.

4. Private Equity Firms

o Enhance due diligence with in-depth market and financial analysis.

Pricing

Finalle AI offers customized pricing based on the size and needs of the financial institution. Contact

the team for a demo and detailed pricing plans.

Strengths

AI-Driven Precision: Delivers actionable insights faster than traditional financial tools.

Tailored Solutions: Customizable financial modeling and reporting to fit institutional needs.

Comprehensive Risk Analysis: Focuses on minimizing risk while optimizing returns.

Drawbacks

Enterprise Focus: Best suited for large-scale financial institutions, not individual investors.

Pricing Transparency: Requires contacting the sales team for detailed costs.

Comparison with Other Tools

Unlike generic portfolio management tools, Finalle AI specializes in advanced analytics and risk

management tailored for institutional use. Its focus on real-time insights and integration capabilities

makes it a powerful alternative to platforms like Bloomberg Terminal or FactSet.

Customer Reviews and Testimonials

1. John T., Investment Manager: Finalle AI transformed how we manage risk. The insights are

unparalleled.

2. Amelia R., Asset Manager: The platform’s predictive modeling has been a game-changer

for portfolio optimization.

3. Ethan K., Financial Analyst: Its visualization tools make presenting data to clients much

easier.

Conclusion

Finalle AI revolutionizes portfolio and risk management with AI-powered analytics tailored for

financial institutions. Its robust features streamline operations, improve decision-making, and

maximize returns, making it an invaluable tool for institutional investors and asset managers.

Visit Finalle AI to request a demo and elevate your financial strategies today.