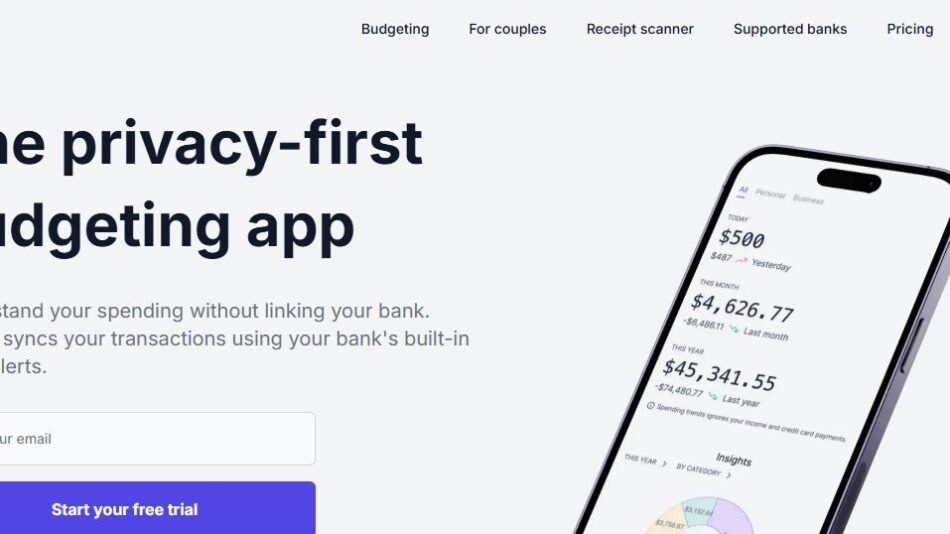

ShowMeMoney is an AI-driven expense tracking platform designed to help individuals gain control

over their finances. With features like automatic transaction syncing, smart categorization, and

customizable notifications, it transforms manual budgeting into an effortless experience. The

platform’s intuitive visualizations and real-time alerts empower users to track spending, stay within

budgets, and start saving effectively.

Features

1. Smart Add

o Uses AI to process and categorize financial data from plain text or bank statements

automatically.

2. Auto Sync

o Connects directly to your bank accounts, logging all transactions automatically

across all accounts.

3. Interactive Charts

o Provides detailed line, bar, and pie charts to visualize monthly and yearly spending

trends.

4. Expense Organization

o Allows categorization by custom labels, time periods, or purposes, making tracking

easier.

5. Budget Notifications

o Sends email alerts when users approach their budget limits.

6. Optional Manual Input

o Offers a manual tracking option for users who prefer not to connect their bank

accounts.

How It Works

Users sign up and either connect their bank accounts via Plaid or manually upload financial data.

ShowMeMoney’s AI categorizes transactions, identifies trends, and organizes expenses into charts

and summaries. Customizable budget alerts keep users informed of their spending in real-time.

Use Cases

1. Personal Budgeting

o Manage daily expenses and save for specific goals with ease.

2. Freelancers

o Track income and expenses across multiple accounts effortlessly.

3. Families

o Organize and monitor household expenses to stay within budgets.

4. Students

o Keep track of spending and manage limited finances effectively.

Pricing

1. Yearly Plan

o $39.99/year (billed as $3.33/month): Includes Smart Add, Auto Sync, notifications,

charts, and organizational tools.

2. Lifetime Plan

o $69.99 one-time payment: Provides lifetime access to all features without recurring

fees.

3. Free Trial

o A 48-hour free trial for users to explore all features before committing.

Strengths

AI-Powered Simplicity: Automates expense tracking and categorization.

Comprehensive Tools: Combines transaction syncing, budgeting, and visualizations in one

platform.

Affordable Pricing: Offers budget-friendly plans with no hidden fees.

Drawbacks

Bank Account Integration Optional: Some features, like auto-sync, may require bank

account connections.

Limited Free Trial: The 48-hour trial may not be enough for all users to evaluate the

platform fully.

Comparison with Other Tools

Unlike traditional budgeting apps like Mint or YNAB, ShowMeMoney emphasizes AI-driven

simplicity, with features like Smart Add for automated categorization and customizable notifications.

Its affordable lifetime plan offers a distinct advantage over subscription-based alternatives.

Customer Reviews and Testimonials

1. Emily T., Freelance Designer: ShowMeMoney has made budgeting so easy. The auto-sync

and charts save me hours every month.

2. Michael R., College Student: I love how it helps me track my expenses without requiring

constant manual input!

3. Sarah L., Busy Parent: Budget notifications and visualizations keep my family’s finances on

track. Worth every penny!

Conclusion

ShowMeMoney revolutionizes personal finance management by combining AI-powered automation

with intuitive tools. From tracking expenses to visualizing financial trends, it ensures users can make

informed decisions and achieve their financial goals.

Visit ShowMeMoney to start your free trial and simplify your budgeting journey today.