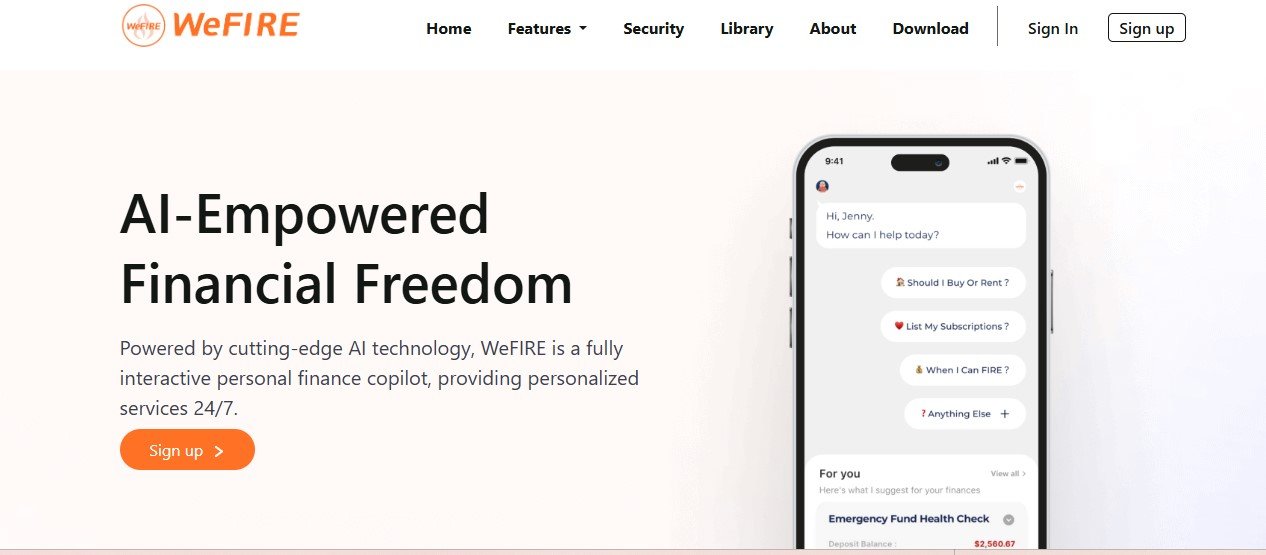

WeFIRE is an AI-powered personal finance platform designed to help individuals achieve their Financial Independence and Retire Early (FIRE) goals. By offering personalized insights, comprehensive financial tracking, and actionable strategies, WeFIRE simplifies the path to financial freedom. Its unique approach combines AI-powered recommendations, tailored budget planning, and a user-friendly interface to help users balance spending, investments, and long-term savings.

Features

- AI Personal Finance Copilot

- Provides 24/7 personalized insights to answer financial questions and guide users toward their goals.

- Comprehensive Account Integration

- Connects all your financial accounts using Plaid for real-time cash flow tracking and analysis.

- FIRE Plan Tracking

- Helps users set and monitor progress toward financial independence with custom budgets and investment advice.

- For You Alerts

- Offers timely updates on account activities and essential financial priorities.

- Educational Resources

- Curated materials to help users understand the principles of FIRE, investments, and financial planning.

- Secure and Transparent

- Upholds industry-leading security standards for data protection and user privacy.

How It Works

WeFIRE aggregates data from connected accounts, using AI to analyze spending patterns, track cash flow, and generate personalized recommendations. Its FIRE Plan feature guides users through actionable steps for reaching financial independence, balancing frugality with lifestyle goals. Users receive continuous updates, enabling them to make timely and informed decisions.

Use Cases

- Aspiring FIRE Enthusiasts

- Plan and monitor progress toward early retirement with tailored tools and resources.

- Budget-Conscious Individuals

- Optimize spending and savings strategies with AI-generated insights.

- Investors Seeking Simplicity

- Access straightforward advice for growing wealth through diversified investments.

- Young Professionals

- Build long-term financial habits and achieve independence faster.

Pricing

- Free Plan

- Includes access to basic features like account integration and spending analysis.

- Premium Plan

- Pricing details are available upon inquiry and offer advanced tools like personalized FIRE planning and in-depth financial analysis.

Strengths

- Personalized Insights: AI-driven recommendations cater to individual financial situations and goals.

- Comprehensive Financial View: Provides a centralized platform to track all accounts and cash flows.

- Educational Focus: Offers robust resources for FIRE planning and investment strategies.

Drawbacks

- Limited Free Features: Advanced tools and full functionality may require a subscription.

- Learning Curve: Users unfamiliar with FIRE concepts might need time to fully utilize the platform’s potential.

Comparison with Other Tools

Unlike traditional budgeting tools like Mint or investment-focused apps like Robinhood, WeFIRE provides a holistic approach by integrating personal finance management with FIRE-specific strategies. It stands out for its AI-powered personalized insights and robust educational resources.

Customer Reviews and Testimonials

- Emma J.: “WeFIRE made my FIRE journey clear and achievable. I now feel in control of my future.”

- Mike R.: “The AI copilot is like having a personal finance coach 24/7. A game-changer!”

- Sophia T.: “The educational resources helped me understand the FIRE movement and set realistic goals.”

Conclusion

WeFIRE empowers users to achieve financial independence through AI-driven insights, secure tools, and a focus on long-term goals. With its innovative features, it’s an excellent choice for anyone looking to master personal finance and retire early.

Visit WeFIRE to start your journey to financial freedom today.